1/4

For

the World

of tomorrow

Our Mission

Van Doorne navigates organizations through tomorrow's world.

Major transitions are on the horizon. The composition of the population is evolving, the climate is changing, power is changing hands ever faster and we are developing a new relationship between humans and technology.

Those transitions are going to affect every sector. We are here to guide you through these transitions. Van Doorne’s lawyers, civil-law notaries and tax lawyers are all about accessibility, a focus on results and an efficient approach. We are pragmatic, straightforward and unfailingly committed.

Together with you, we always look for the best solution.

Van Doorne is already working for tomorrow today.

Our People

We know change is done by people and our people make the difference for you.

Our Services

For tomorrow's Challenges

Transactions

Van Doorne will assist you with your transactions. We have extensive experience in all types of transactions like acquiring a company, raising equity or borrowed capital, buying or selling real estate, entering into a joint venture, carve-outs of business units or setting up a fund.

Litigation

Disputes have a huge impact. For decades, Van Doorne has been the leading firm that provides considered, effective and timely litigation advice and assistance.

Regulatory

Van Doorne's team has in-depth knowledge of the national and European laws and regulations that regulate clients' business operations.

Investigations

Van Doorne assists you when internal investigations need to be carried out within your organisation.

Recent articles

2 min read

Vanessa Liem included in the GIR Top 100 ‘Women in Investigations 2025’

18 June 2025

Nieuws

3 min read

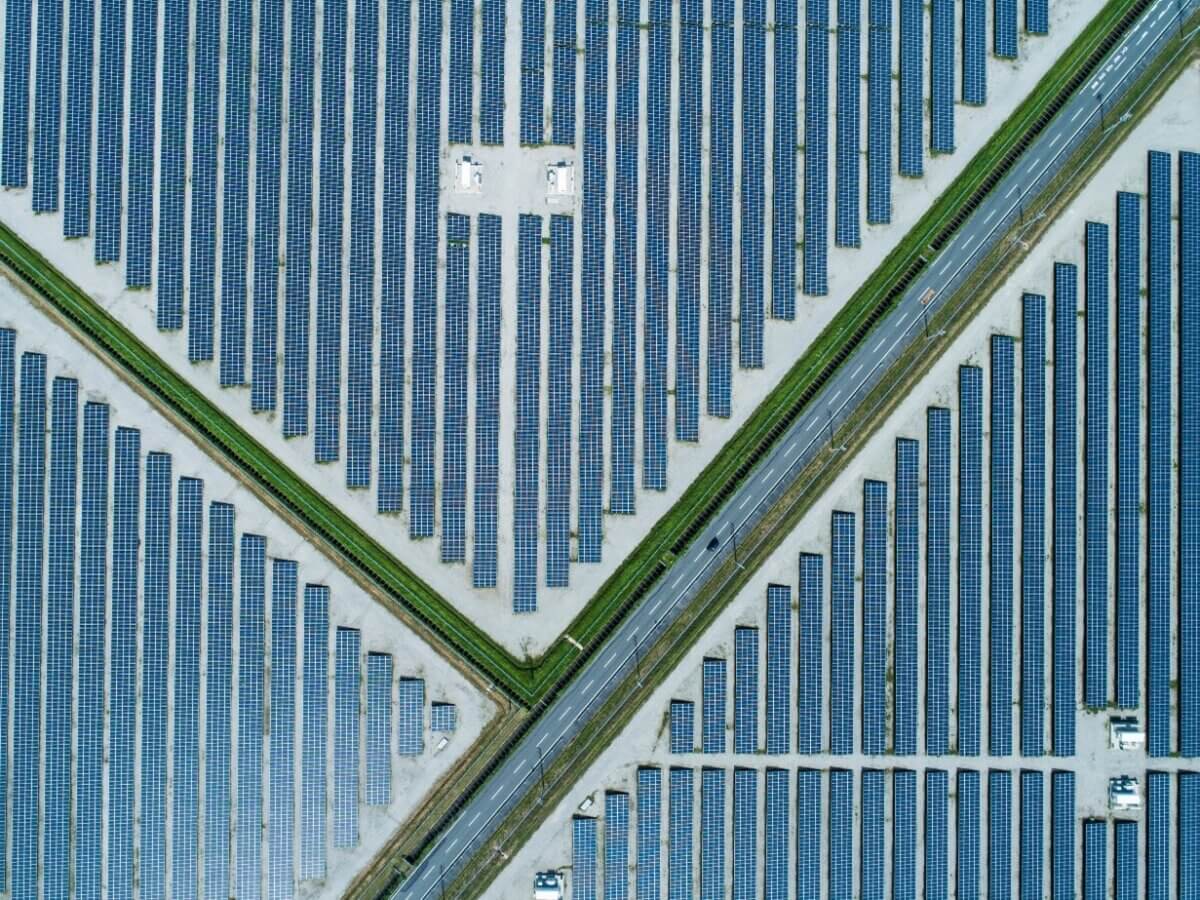

Van Doorne Delivers Three Green Ambassadors: Klapwijk, Maessen, and Van Ahee Recognized as Legal Leaders in the Energy Transition

16 June 2025

Artikel

2 min read

BESSContracts & Regulatory Overview (Part 1)

12 June 2025

Nieuws

6 min read

Pledge Prohibition Act: What you need to know and how to prepare

15 May 2025

1 min read

Solar Update Q2 2025

9 May 2025

2 min read

Van Doorne advises Rockfield and Ardian on largest PBSA deal in the Netherlands

6 May 2025

Neyah

Noortje

Alexandra

Bastiaan

Eline

Ilse

Souad

Hannah

Andy

Benjamin

Jan

Ariën

Maurits

Guusje

Tanya

Julia

Saskia

Your name?

Saskia

Jasper

Nikki

Jeroen

Dylan

Tycho

Sophie

Dennis

Bart

Willem

Ruben

Noa

Loes

Rob

Nelly

Özer